Trump impact on EV industry and sales

Feb. 7th, 2026 08:56 amAs expected, Trump had it in for EVs as Battery Technology reports. Excerpts:

At a Glance

* Tariffs on EV components raised costs for manufacturers and slowed infrastructure development nationwide

* Federal EV tax credits terminated in September 2025 reducing consumer purchase incentives significantly

* NEVI charging program froze approvals delaying corridor fast-charging station deployment across states

Exactly one year ago today, Donald Trump was inaugurated as US President for the second time. One year on, it’s worth noting how his 2025 policy reset has reshaped the US EV landscape. Tariffs lifted costs across vehicles, batteries, and charging hardware. Federal infrastructure momentum stalled. Regulatory drivers that encouraged EV adoption were weakened. And incentives that helped close price gaps for consumers and fleets were curtailed or timed out.

In aggregate, these moves narrowed near‑term competitiveness for domestic EV makers as Chinese OEMs continued scaling volumes and cutting costs abroad—pressuring US incumbents at precisely the moment the global market is accelerating.

Here is the timeline of eleven specific government actions undertaken last year that worked against the interests of EV developers and customers.

1. January 20, 2025: Day‑One executive order reorients energy and EV policy

2. February 6–7, 2025: FHWA freezes NEVI plan approvals and new obligations

3. Early March 2025: Federal fleet retreat from EVs; charger deactivations

4. April 2, 2025 (effective April 5): Global “reciprocal” tariff regime

5. April 18, 2025 (effective May 19): FHWA repeals highway GHG performance measure

6. June 11, 2025: NHTSA “resets” CAFE, excluding EVs and credit trading

7. June 12, 2025: CRA resolutions target California’s EPA waivers

8. July 4, 2025: “One, Big, Beautiful Bill Act” curtails EV credits; removes CAFE penalties

9. July 30, 2025 (effective August 29): De minimis duty‑free entry suspended

10. August 1, 2025 — EPA Proposes to Rescind the Endangerment Finding and Tailpipe GHG Standards

11. December 5, 2025 — NHTSA Proposes SAFE Rule III, Weakening Light‑Duty CAFE and Ending Credit Trading

2026: The rest of the world moves forward as US automakers navigate constraints

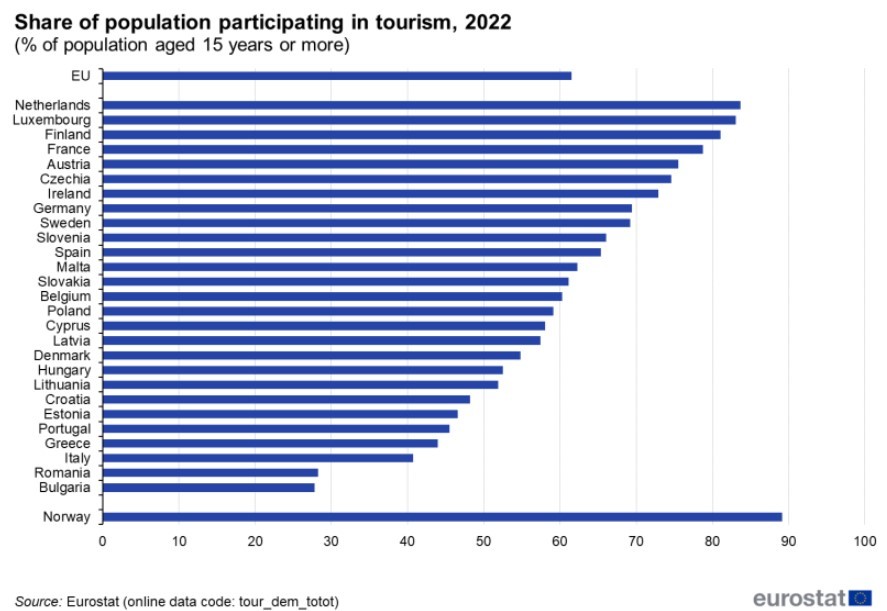

The 2025 data paint a clear gap: EVs were roughly 11% of U.S. new‑car sales versus nearly one in four across Europe (EU BEV share 16.9% year‑to‑date by November) and about 60% in China—evidence that mainstream adoption is advancing faster abroad. Charging infrastructure tells the same story: China added hundreds of thousands of public fast chargers in 2024–2025, lifting public charging capacity per EV above 3 kW, while the US reached only about 65,000 DC fast‑charging ports by November 2025. And mature markets such as Norway are already near‑fully electric—95.9% of new‑car sales in 2025—underscoring how much ground the US must make up.

And just this week, Canada signed a strategic agreement with China that opens the door to higher-range, lower‑cost Chinese‑made EVs entering the Canadian market under a 6.1% MFN tariff, with an initial quota of 49,000 vehicles and an affordability target that reserves half of the quota for EVs priced under CAD $35,000 by 2030. This development increases competitive pressure at America’s doorstep.

The race for EV market share was never going to be easy for US automakers. It’s too bad the federal actions of 2025 make it even harder for them to keep pace.